National policies and competitive local wind turbine makers are supporting offshore wind installations along China’s eastern coasts. Opportunities might arise for composite manufacturers in this specific market.

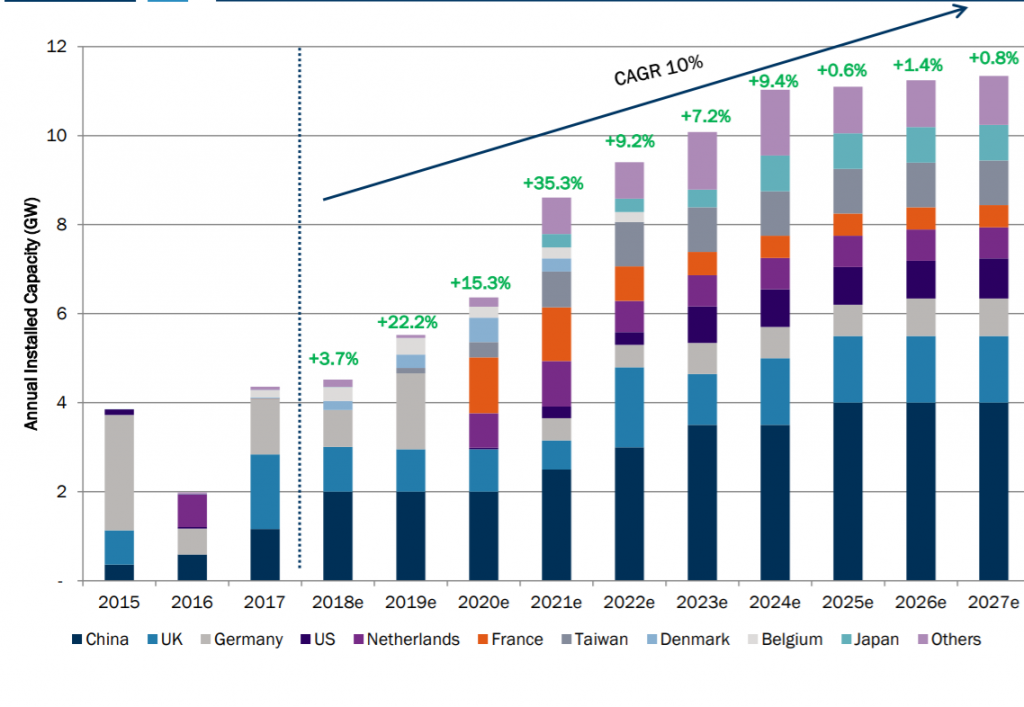

Not a day goes by without reading news about a Chinese company setting wind turbines offshore. « Asia Pacific is likely to replace Europe as the leading region in new additions in 2018-2027, which is primarily due to the upgraded offshore wind forecasts for China and Taiwan », says FTI Consulting in its annual Global Wind Market Update. According to the London-based analyst firm, the global offshore wind market is likely to grow from 4,518 [megawatt (MW)] in 2018 to 11,340 MW in 2027. The compound annual growth rate across the 10 years is 10%, almost quadruple the rate for onshore wind.

The China National Energy Administration sets a national target of 5 GW [gigawatt (GW)] of grid-connected capacity by 2020 in the 13th five-year plan (2016-2020) to support the development of the country’s offshore wind market. « China has a stable market with clear policy support. Every five years, the country issues a national renewable energy target and executes the programme accordingly. China is also an emerging market in offshore development. The Chinese offshore market started in 2010 with 15 MW of installations and with low activity until 2017. Then, in 2017, the market started to grow very fast with 1,160 MW of new installations – up from 59 MW of new installations in 2016. In 2018, 1,600 MW was added », explains Alexis Crama, VP, Offshore at LM Wind Power (acquired by GE Renewable Energy in 2017).

Extension up north

In January 2019, East China’s Jiangsu province approved 24 offshore wind power projects with a total capacity of 6.7 GW, said sources within the State Grid Jiangsu Electric Power Co. Ltd. to Chinese national agency Xinhua. The projects, which are expected to be completed before the end of 2020, are part of Jiangsu’s 10 GW-level offshore wind power plan known as ‘Three Gorges on Sea’. They represent a total investment of CNY 122.29 billion (around US$ 18 billion).

Jiangsu province leads offshore wind development in China, with further capacity being split between the Fujian, Guangdong, Zhejiang and Hebei provinces. The beginning of 2019 also saw the Chinese offshore territory expanding in the north-eastern province of Liaoning, with the first northern sea wind farm installed by Goldwind (金凤) – China’s leading wind turbine manufacturer.

The Chinese offshore wind market has its own characteristics. « Many projects along the Chinese east coast, especially in Jiangsu and Zhejiang provinces, are inter-tidal projects. Typhoons are a challenge for projects in Fujian and Guangdong provinces », details Feng Zhao, strategy director at the Global Wind Energy Council (GWEC). Anti-typhoon installations are needed to switch off the turbines during these harsh weather conditions.

Higher quality, larger blades

The demands of the offshore wind market are also specific. Offshore blades require higher quality and reliability compared with onshore blades, due to the large investment involved and to the high operation and maintenance costs in the service phase.

« Some characteristics of China’s wind projects include lower wind speeds and projects closer to coast lines. So, the race to double-digit MW platforms is more tempered, but the key driver is increasingly larger blades for enhancing capacity factors. Designing, developing and manufacturing ultra-long blades, with high quality, is the core capability of LM Wind Power and we intend to leverage this », says Alexis Crama, who adds that China is learning from the experience of the more mature European market, while at the same time establishing fast, localized mechanisms to support its development. Local turbine makers dominate the market with competitive prices compared with global turbine makers.

Goldwind (金凤), Envision (远景) and Ming Yang Smart Energy (明阳智能) are China’s top three players – rankings they have held since 2016 – with Goldwind installing over 6 GW, Envision putting up 4-5 GW, and Ming Yang Smart Energy 3-4 GW, as estimated by China Wind Energy Association (CWEA).

Together, the trio took 61.5% of the Chinese market, respectively seven and 17.4 percentage points up from their shares in the previous two years, indicating the further consolidation of the domestic wind market. Following the top three, CSIC Haizhuang (中国海装), Shanghai Electric (上海电气), Windey (运达风电), and Guodian United Power (国电联合) collectively built 4.4GW and took fourth to seventh places.

As one of the few foreign firms operating in the Chinese offshore wind market, « LM Wind Power is gaining ground in China’s competitive domestic landscape thanks to leading technology and highly-reliable manufacturing. Our company works with four out of the top five offshore wind turbine manufacturers in China », Alexis Crama underlines. The company built its first factory in China in 2001, and has now four factories located in Qinghuangdao, Baodi, Jiangying and Fuqing, while employing over 3,000 people. The Jiangying (Jiangsu province) and Fuqing (Fujian province) factories produce offshore blades for the domestic market.

« We see China as one of the strategic markets for LM Wind Power », Alexis Crama continues. « We are preparing additional, dedicated offshore capacity this year to cope with increasing demand for large blades. Currently, our blades in China are 6X and 7X metres in length, and blades well above 80 metres in length will come soon to serve the country’s offshore business. » Another key project for LM Wind Power is to reinforce its blade service business to support the growth of its offshore business in China.

Less turbines, more carbon fibre

« If the space is limited for foreign turbine and blade manufacturers, foreign material suppliers can take advantage of the Chinese wind offshore market’s dramatic rise », says Feng Zhao. However, the growth of the materials needed might not be as high as expected. Price pressure and efficiency improvement will quickly begin to affect component suppliers as turbines become more powerful, according to new figures published by research firm Wood Mackenzie Power & Renewables, as reported by the CleanTechnica information website.

« Global wind annual installations are expected to grow by 40% in the next decade », says Shashi Barla, senior analyst at Wood Mackenzie Power & Renewables. « Pressure to lower the levelized cost of electricity is accelerating technology developments, which is causing a wider proliferation of next-generation 4.X/5.X/6.X turbines. As a result, we expect a 20% decline in the total number of turbines deployed, from over 20,000 turbines in 2018 to just over 16,000 by 2027. »

According to Shashi Barla, this development will also impact the materials used. « As blade length increases on next-generation turbines, carbon fibre utilization for structural blade support is expected to increase its market share, from 25% in 2018 to around 57% by 2027, due to its light-weighting potential and other advanced properties. »

This evolution might not concern, at least in the first stage, the Chinese offshore wind market. « 4-7 MW turbines, which are mainly produced in glass fibre, are the main turbine types for China offshore in the near term », specifies Alexis Crama. « Longer and lighter blades are the future trend in the offshore sector, which requires carbon fibre or a carbon and glass fibre blade. However, given cost and complexity, this might come a bit later to China. »

This feature has been commissioned and published by JEC Group in JEC Composites Magazine n°128